Ethereum is the leading smart-contract platform for decentralized finance (DeFi), non-fungible tokens (NFTs), stablecoins, and many other decentralized applications. It is also the second-largest cryptocurrency by market capitalization.

In the past few years, Ethereum has gone through major structural changes. The most important of these is the switch to proof-of-stake, which gave the market a boost and helped it reach and beat its previous all-time highs.

Because ETH plays a big role in blockchain infrastructure and yield-earning mechanisms like staking, its price trends are tracked not just as speculative indicators but as reflections of network utility and adoption.

History of Ethereum

Ethereum was launched in July 2015 after being proposed by Vitalik Buterin in 2013 and developed through a public crowd sale in 2014. After introducing smart contracts, it quickly climbed to the top of the decentralized application market.

Early price movement was low; in 2015, ETH was trading below $1. It didn’t start to rise significantly until 2017, when it surpassed $100 and ended the year at about $774. Due to DeFi expansion, network improvements, and institutional interest, ETH experienced a significant bull run in August 2025, reaching an all-time high of about $4,946.

In 2022, Ethereum made the shift from proof-of-work to proof-of-stake, which changed its economic model.

Ethereum (ETH) Price Prediction for 2026

CoinCodex’s long-term predictions say that Ethereum will trade in a wide range in 2026. This range will include both periods of strong upward momentum and corrective pullbacks as the market stabilizes after recent volatility.

Q1 2026 (January – March)

Ethereum is expected to begin 2026 with an average price of $3,200 in January, with a minimum price of about $2,937 and an upside potential of $3,546. The momentum picks up steam in February and March, when forecasts predict a spike in volatility. By March, ETH might be trading between $4,035 and $5,342, with an average price of about $4,717 – one of the highest points of the year.

Q2 2026 (April – June)

April is still optimistic, with Ethereum possibly reaching a peak of $5,579 while keeping its average price near $4,849. But the data indicate that in May and June, momentum starts to slow down. After a strong first-quarter rally, average prices gradually drop toward the $3,800–$4,500 range, indicating a period of consolidation.

Q3 2026 (July – September)

Ethereum is predicted to trade more sideways in the third quarter. Prices are expected to be between $3,455 and $4,203 per month, with lower levels remaining above $3,200. CoinCodex data shows that ETH maintains a fairly stable trading structure without big breakdowns, even though sharp breakouts seem less likely during this time.

Q4 2026 (October – December)

There are indications of a slow recovery in the last quarter of 2026. The average price of Ethereum is expected to increase from $3,577 in October to $3,783 by December, with maximum targets close to $3,893.

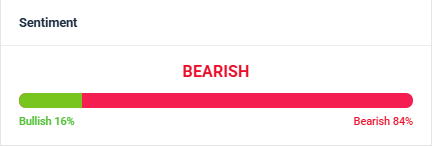

Short Technical Analysis (2026)

According to CoinCodex’s technical analysis, the market sentiment is currently bearish, with 84% of indicators indicating bearish conditions and 16% indicating bullish conditions. Ethereum is still in a clear trading channel for 2026, with expected price movement between $2,937 and $5,579, despite this short-term bearish trend. As long as Ethereum maintains important support levels, the forecast suggests that long-term structure will remain intact despite high volatility.

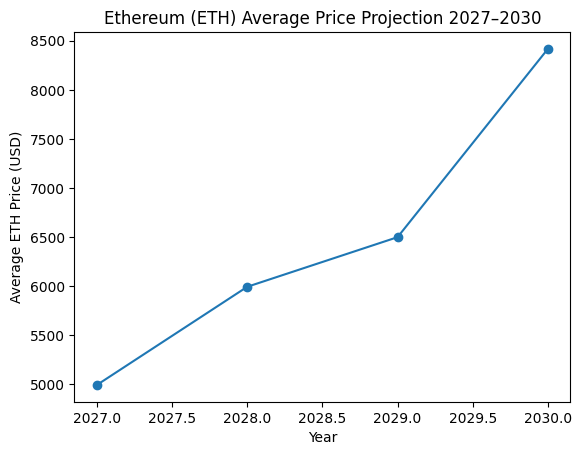

Ethereum (ETH) Price Prediction 2027–2030

Long-term projections from CoinCodex show that Ethereum will continue to rise between 2027 and 2030, with higher average prices every year but ongoing volatility over shorter periods of time.

Ethereum Price Prediction for 2027

According to the data, Ethereum might move between $4,012 and $5,849 in 2027. Average prices start the year at about $4,460 in January and progressively increase until the middle of the year. ETH experiences one of its strongest periods between May and June, with average prices rising above $5,200 and maximum targets getting close to $5,850. Following early gains, prices stabilize in the second half of the year, averaging between $5,000 and $5,300.

Ethereum Price Prediction for 2028

The expected price movement of Ethereum in 2028 reveals that long-term growth will continue, driven by higher lows and wider trading ranges. According to projections by CoinCodex, ETH will trade between $4,396 and $8,137 throughout the year. Growth is slow in the first half of 2028, but momentum picks up speed in the middle of the year. Maximum monthly goals surpass $8,100, while average prices increase from $6,085 to over $7,650 between June and October. With an estimated average yearly price of about $5,991, ETH maintains high price levels by year’s end, indicating growing market confidence.

Ethereum Price Prediction for 2029

Ethereum is expected to move between $4,295 and $8,078. With average prices in January moving around $6,792, the year begins strongly before peaking once more near the end. Even though there is a small drop in mid-2029, with averages falling near $5,050, prices recover in the last quarter. ETH may see average levels above $7,130 by December. In 2029, the average yearly price is expected to be around $6,497.

Ethereum Price Prediction for 2030

Throughout the year, ETH is predicted to vary between $7,765 and $8,954. Starting at about $8,066 in January and progressively increasing to $8,330 by December, average prices consistently stay above $8,000. The estimated average annual price for 2030 is approximately $8,417, positioning Ethereum as a high-value long-term digital asset.

Key Drivers Behind Ethereum’s Price Growth

First, network utility and adoption continue to be crucial. Since ETH is the primary smart-contract platform behind DeFi, NFTs, and tokenized assets, the need for it to cover transaction fees and secure applications fuels price growth. The demand for ETH is strengthened by increased network activity and wider adoption of Layer-2 scaling, which also improves efficiency while maintaining decentralization.

Institutional involvement is yet another important motivator. Traditional investors can now obtain regulated exposure thanks to the approval of spot ETH ETFs and expanding custody solutions, which could result in capital inflows.

Other factors are supply mechanics and monetary policy. The fee-burning mechanism of EIP-1559 and post-merger staking can lower circulating supply and drive up prices.

The role of ETH in diversified portfolios and investor confidence will be influenced by macro trends like regulatory clarity and wider adoption of digital assets.

Risks That Could Affect Ethereum’s Price

Ethereum has a number of risks that could affect its price outlook, even with its potential for long-term growth.

- High market volatility: Ethereum remains highly sensitive to macroeconomic conditions, interest rate changes, and shifts in investor risk appetite.

- Regulatory uncertainty: Changes in crypto regulations, asset classification, or compliance requirements may limit institutional participation and create short-term downward pressure on ETH.

- Growing competition: Alternative blockchains offering faster transactions and lower fees could attract developers and users away from Ethereum.

- Execution and upgrade risks: Delays or issues related to Ethereum’s scalability upgrades may slow adoption or impact confidence in long-term development plans.

- Smart contract and DeFi risks: Security vulnerabilities, protocol exploits, or high-profile hacks within Ethereum’s ecosystem can damage market sentiment.

- Broader crypto market dependency: Ethereum’s price remains closely correlated with Bitcoin and overall crypto market cycles.

Should You Invest in Ethereum (ETH)?

Most people consider Ethereum to be a long-term investment and not a short-term trading asset. In DeFi, NFTs, stablecoins, and tokenized real-world assets, their value is strongly correlated with network usage, developer activity, and adoption. Investors who think that blockchain infrastructure and on-chain applications will continue to grow might consider ETH to be their primary investment.

But there are risks associated with Ethereum. Over shorter time periods, performance may be impacted by price volatility, regulatory changes, and competition from other blockchains. Longer-term investors who are comfortable with market swings and are aware of the associated risks might find ETH more appealing.

Conclusion

The price forecast for Ethereum between 2026 and 2030 shows the evolution from a developing blockchain to a well-established digital infrastructure. ETH’s long-term valuation is influenced by network demand, staking participation, and its role in supporting decentralized applications across multiple industries.

Forecasts from CoinCodex suggest that prices will gradually increase over time, but volatility will always be a factor. Ethereum’s wide ecosystem and continuous development continue to offer structural support even though external risks like market cycles and regulations can affect performance.

Frequently Asked Questions

How much will 1 ETH be worth in 2030?

Based on forecasts, Ethereum could trade around the $8,000–$9,000 range by 2030, depending on market conditions and adoption growth.

What is the price of Ethereum in 2025?

Ethereum’s price in 2025 is expected to remain volatile, with forecasts generally placing ETH in the mid-$3,000 to low-$4,000 range under neutral market conditions.

Will Ethereum hit $10,000?

Ethereum could reach $10,000 in a strong long-term market scenario, but this would likely require sustained institutional adoption and favorable macro conditions.

How high can ETH realistically go?

Realistically, ETH’s upside is tied to network usage and market cycles, with many long-term forecasts suggesting high four-figure to low five-figure levels in optimistic scenarios.