Binance Coin (BNB) is one of the most used cryptocurrencies. It powers the Binance ecosystem, including trading fee discounts, token launches, and activity on BNB Chain. As crypto markets mature, many investors are looking beyond short-term price moves and asking a bigger question: where could $BNB be by 2026, 2027, or even 2030?

Here in this article, we will look into realistic price predictions for $BNB based on market trends, historical performance, ecosystem growth, and also both bullish and bearish scenarios.

What Is Binance Coin ($BNB)?

Binance Coin ($BNB) is the main cryptocurrency used across the Binance ecosystem. It was launched in 2017 and first used to give traders discounts on Binance trading fees. Since then, BNB has grown into a token with a much bigger role.

Today, BNB is used to pay fees on Binance and on BNB Chain, take part in token launches, and support applications built within the Binance ecosystem. Its value is closely tied to the platform’s activity and success.

One important feature of $BNB is its token burn system. Binance regularly removes BNB from circulation, which lowers the total supply over time. If demand stays strong, this reduced supply can support long-term price growth.

$BNB Price History Overview

Binance Coin (BNB) was launched in 2017 and initially traded at just a few cents. As Binance quickly grew into one of the largest crypto exchanges, BNB’s price increased steadily during its first year, reaching several dollars by the end of 2017.

Like the rest of the crypto market, BNB saw a sharp drop during the 2018 bear market. However, it recovered strongly in the following years. During the 2020–2021 bull market, BNB experienced major growth as Binance expanded and BNB Chain gained traction. In 2021, BNB reached an all-time high above $600.

$BNB continued this upward trend over the following cycle and reached its all-time high of approximately $1,369 in October 2025. While prices have pulled back from this peak as the market cooled, BNB remains above its early years and maintains significant trading volume and market cap.

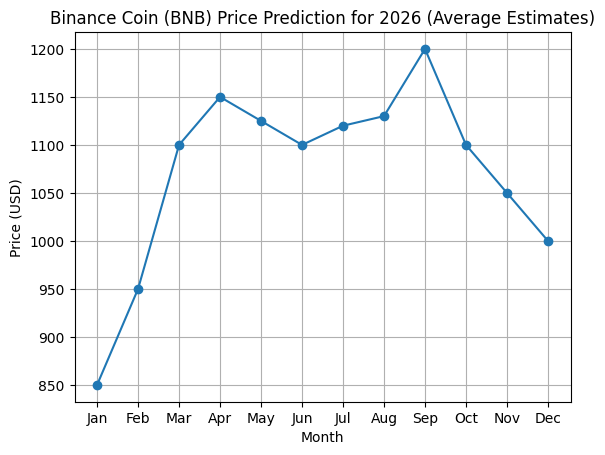

Binance Coin ($BNB) Price Prediction for 2026

Based on CoinCodex projections, 2026 could be a growth year for Binance Coin, with prices gradually increasing through most of the year before stabilizing toward the end.

January to March 2026

BNB is expected to start 2026 around the mid-$800 range and move higher during the first quarter. Average prices are projected to climb close to $1,100 by March, with upside potential above $1,200 if market sentiment remains positive.

April to June 2026

During the second quarter, BNB could continue trading above $1,100 on average. Price estimates suggest short-term pullbacks are possible, but overall momentum remains upward. Maximum monthly targets during this period move closer to the $1,300 level.

April to June 2026

During the second quarter, BNB could continue trading above $1,100 on average. Price estimates suggest short-term pullbacks are possible, but overall momentum remains upward. Maximum monthly targets during this period move closer to the $1,300 level.

October to December 2026

Toward the end of the year, CoinCodex forecasts suggest some cooling. Average prices may drift closer to the $1,000–$1,050 range, with lower volatility compared to earlier months. This could indicate consolidation after a strong year rather than a trend reversal.

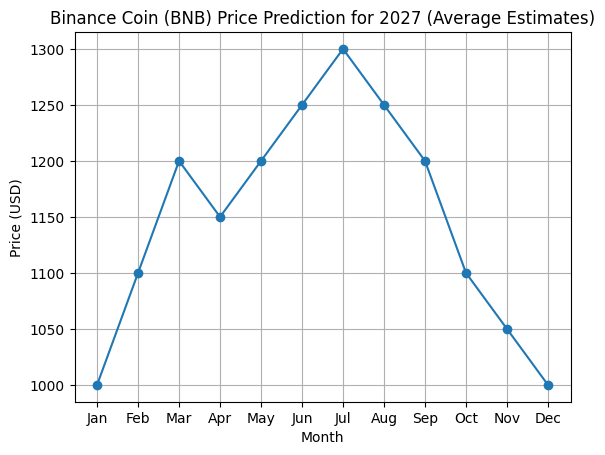

Binance Coin ($BNB) Price Prediction for 2027

CoinCodex projections suggest that 2027 could be a more stable but still positive year for BNB.

January to March 2027

BNB is projected to begin 2027 close to the $1,000 mark. During the first quarter, average prices are expected to rise into the $1,200 range, with monthly highs reaching slightly above $1,300.

April to June 2027

In the second quarter, BNB may trade more consistently between $1,150 and $1,250 on average. May and June stand out as stronger months, with upside potential moving toward the mid-$1,300 range.

April to June 2027

In the second quarter, BNB may trade more consistently between $1,150 and $1,250 on average. May and June stand out as stronger months, with upside potential moving toward the mid-$1,300 range.

October to December 2027

The final quarter looks to be weaker compared to earlier months. Average prices may drop closer to the $1,000 level, with some downside pressure toward the end of the year.

Binance Coin ($BNB) Price Prediction for 2028–2030

According to CoinCodex forecasts, Binance Coin’s price may move from recovery and consolidation to more steady, long-term growth between 2028 and 2030.

$BNB Price Prediction for 2028

CoinCodex predicts that 2028 may begin as a comparatively slow year for BNB before picking up steam in the second half. Average prices are expected to remain mostly between $850 and $980 during the first few months, indicating consolidation based on previous market cycles. Momentum seems to pick up after the middle of the year, with prices rising back above $1,000. The end of the year is predicted to see the biggest growth, with monthly highs approaching $1,480 and average prices possibly reaching the $1,300 range.

| Month | Min Price (USD) | Avg Price (USD) | Max Price (USD) | Change |

|---|---|---|---|---|

| Jan 2028 | $965.97 | $975.33 | $982.61 | 13.29% |

| Feb 2028 | $851.45 | $892.15 | $961.42 | 10.85% |

| Mar 2028 | $851.72 | $870.29 | $884.50 | 1.98% |

| Apr 2028 | $853.25 | $868.62 | $883.62 | 1.88% |

| May 2028 | $839.00 | $858.99 | $900.15 | 3.79% |

| Jun 2028 | $907.41 | $942.29 | $1,004.71 | 15.84% |

| Jul 2028 | $922.86 | $977.76 | $1,017.80 | 17.35% |

| Aug 2028 | $922.55 | $953.02 | $1,011.47 | 16.62% |

| Sep 2028 | $959.87 | $1,112.75 | $1,282.03 | 47.82% |

| Oct 2028 | $1,187.71 | $1,224.66 | $1,260.30 | 45.31% |

| Nov 2028 | $1,161.21 | $1,206.68 | $1,257.91 | 45.04% |

| Dec 2028 | $1,199.70 | $1,333.68 | $1,488.68 | 71.64% |

$BNB Price Prediction for 2029

According to CoinCodex projections, 2029 might be a very bullish year for BNB. It is expected that prices will rise significantly above prior ranges, with average values remaining above $2,000 for the majority of the year. BNB will begin trading between $1,700 and $2,100 on average in the first few months, and it will continue to rise steadily through the middle of the year. Market confidence can be seen by monthly highs that continuously move toward the $2,250 range.

| Month | Min Price (USD) | Avg Price (USD) | Max Price (USD) | Change |

|---|---|---|---|---|

| Jan 2029 | $1,485.50 | $1,685.03 | $2,060.41 | 137.56% |

| Feb 2029 | $2,027.13 | $2,179.91 | $2,255.42 | 160.05% |

| Mar 2029 | $2,076.03 | $2,193.34 | $2,275.50 | 162.36% |

| Apr 2029 | $2,146.63 | $2,234.47 | $2,277.31 | 162.57% |

| May 2029 | $1,890.11 | $2,198.33 | $2,261.38 | 160.74% |

| Jun 2029 | $1,945.78 | $2,110.67 | $2,276.92 | 162.53% |

| Jul 2029 | $1,790.04 | $2,076.71 | $2,254.16 | 159.90% |

| Aug 2029 | $1,985.49 | $2,109.40 | $2,243.65 | 158.69% |

| Sep 2029 | $1,905.12 | $2,026.82 | $2,138.50 | 146.57% |

| Oct 2029 | $2,089.65 | $2,166.77 | $2,244.15 | 158.75% |

| Nov 2029 | $2,149.08 | $2,222.50 | $2,273.65 | 162.15% |

| Dec 2029 | $2,116.27 | $2,198.60 | $2,243.46 | 158.67% |

$BNB Price Prediction for 2030

According to CoinCodex forecasts, BNB will enter a more mature phase by 2030, with consistent price movement instead of quick jumps. Throughout the year, average prices are predicted to move between $2,250 and $2,400, with monthly highs approaching $2,450. Compared to previous years, price movement looks more consistent, showing less volatility and a more stable marketplace. BNB maintains high levels, showing long-term trust in the ecosystem.

| Month | Min Price (USD) | Avg Price (USD) | Max Price (USD) | Change |

|---|---|---|---|---|

| Jan 2030 | $2,197.32 | $2,264.87 | $2,288.33 | 163.84% |

| Feb 2030 | $2,280.40 | $2,297.16 | $2,312.21 | 166.60% |

| Mar 2030 | $2,293.29 | $2,321.48 | $2,344.19 | 170.28% |

| Apr 2030 | $2,319.20 | $2,382.41 | $2,419.49 | 178.97% |

| May 2030 | $2,358.81 | $2,385.12 | $2,417.04 | 178.68% |

| Jun 2030 | $2,345.52 | $2,362.33 | $2,378.44 | 174.23% |

| Jul 2030 | $2,342.17 | $2,356.71 | $2,371.50 | 173.43% |

| Aug 2030 | $2,347.75 | $2,357.18 | $2,377.57 | 174.13% |

| Sep 2030 | $2,348.97 | $2,397.23 | $2,449.50 | 182.43% |

| Oct 2030 | $2,335.70 | $2,364.83 | $2,420.37 | 179.07% |

| Nov 2030 | $2,355.20 | $2,377.26 | $2,401.44 | 176.88% |

| Dec 2030 | $2,309.45 | $2,324.46 | $2,352.72 | 171.27% |

Bullish vs Bearish $BNB Price Scenarios

The performance of the Binance ecosystem, the state of the cryptocurrency market, and outside factors like regulation will all affect BNB’s future price.

Bullish Scenario

BNB could perform well if Binance continues to dominate the exchange market and BNB Chain remains widely used. Regular token burns reduce supply, which can support price growth when demand stays strong. A broader crypto bull market, driven by Bitcoin and institutional interest, would likely push BNB higher as well. Increased DeFi and on-chain activity on BNB Chain could further strengthen long-term demand.

Bearish Scenario

On the downside, BNB remains exposed to market volatility and regulatory pressure. Negative news related to centralized exchanges could weaken investor confidence and slow demand. If trading volumes fall or BNB Chain loses activity to competitors, price momentum could fade. In broader market downturns, BNB may also face extended periods of consolidation or correction.

Is Binance Coin a Good Long-Term Investment?

Due to its practical use within the Binance ecosystem, Binance Coin (BNB) is often seen as a long-term investment. It is used for BNB Chain activity, on-chain transactions, and trading fee reductions.

By regularly burning tokens, Binance also lowers the supply of BNB, which can support its long-term value. However, because BNB is closely linked to Binance as a centralized exchange, its performance may be influenced by regulatory problems or decreased platform usage.

Overall, BNB’s long-term goals are based more on market conditions, ecosystem expansion, and constant user demand.

Conclusion

Binance Coin has seen some pretty impressive growth over the years. Forecasts for 2026 to 2030 indicate that $BNB may continue to grow over time. As with most cryptocurrencies, market cycles, ecosystem usage, and outside factors like regulations will all have an impact on BNB’s price in the future.

It’s important to remember that, despite optimistic forecasts that point to the coin’s potential for significant growth, none of them are absolute guarantees.

Frequently Asked Questions

Will BNB reach $10,000?

Reaching $10,000 would require extreme growth and very strong market conditions, which most forecasts do not currently support.

What will be the price of BNB in 2025?

Most predictions place BNB in the high hundreds to low thousands range in 2025, depending on market momentum and adoption.

Is BNB a good buy?

BNB may be appealing to long-term holders due to its utility and ecosystem use, but it still carries market and regulatory risks.

Can BNB reach $5,000?

Some long-term forecasts suggest $5,000 is possible in a strong bull market, but it would depend on sustained demand and broader crypto growth.